Sit back and relax.

Let us do all the hard work!

When you are ready to go ahead we can put together the complex loan application and manage all the correspondence.

The first step is for you to provide us with an overview of your situation and requirements. Once we receive your completed questionnaire, it is likely that we'll contact you to discuss your situation and our advice further.

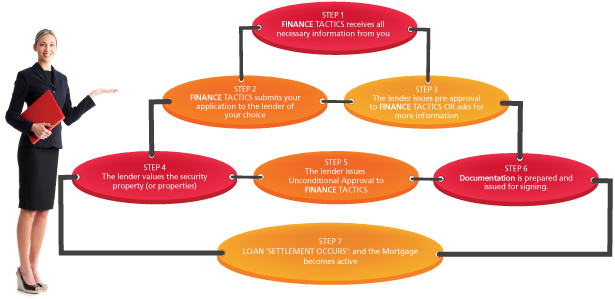

Although each loan transaction is unique, most applications for mortgage finance involve seven clear steps to completion. See the flow chart that demonstrates the process for a typical mortgage transaction.